Dark Side of Digitalization

The dark side of digitalization is becoming increasingly apparent, as highlighted in the Reserve Bank of India’s (RBI) recent Currency and Finance (RCF) report for 2023-24. While digital advancements in the financial sector have enhanced convenience and accessibility, they also pose significant risks, including impulsive expenditure and data breaches. This article delves into these concerns, analyzing the RBI’s findings and their implications for consumers and financial stability.

Impact of Digitalization on Consumer Behavior

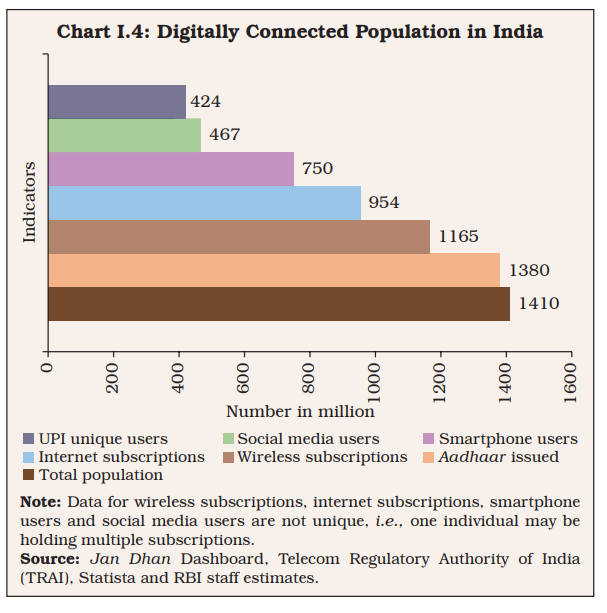

Digitalization has fundamentally transformed how financial services are consumed. The rise of mobile and internet connectivity allows consumers to access a variety of financial products instantly. However, this convenience can lead to the dark side of digitalization, where increased accessibility triggers impulsive spending behaviors.

Consumers are now more exposed to financial trends and investment opportunities through digital platforms. Social networks rapidly disseminate information about investments and spending habits, often leading to a herd mentality. This mass influence can cause individuals to make hasty financial decisions, potentially harming their financial well-being.

Impulsive Expenditure and Financial Stability

The RBI report reveals that the dark side of digitalization includes impulsive spending driven by the visibility of others’ financial activities. Observing large groups engaging in buying frenzies or market speculation can lead individuals to follow suit, resulting in unplanned expenditures. This behavior jeopardizes personal financial stability and can lead to broader economic instability.

Additionally, ostentatious behavior influenced by digital platforms may prompt depositors to withdraw funds from banks, risking potential bank runs or financial crises. Such trends emphasize the need for awareness and caution in managing finances in the digital age.

Threat of Data Breach

Another significant concern highlighted in the RBI report is the growing threat of data breaches. The dark side of digitalization also encompasses the rising frequency and cost of cyberattacks. In 2023, the average cost of a data breach in India soared to $2.18 million, marking a 28% increase from 2020. Globally, cybercrime costs are projected to reach $13.82 trillion by 2028.

Data breaches can lead to severe consequences, including financial loss, identity theft, and reputational damage. As digital transactions and data sharing become more prevalent, safeguarding against data breaches is crucial. The RBI underscores the importance of robust data security measures and cross-border digital trade policies to protect consumer data and enhance trust in digital financial systems.

Regulatory Measures and Recommendations

Addressing the dark side of digitalization requires a strong regulatory framework. Regulatory bodies must establish clear guidelines for digital financial services, focusing on data protection and cybersecurity standards. Enhanced cybersecurity measures are essential for financial institutions. Investments in encryption, firewalls, and intrusion detection systems are critical to safeguarding against cyber threats.

Furthermore, promoting financial literacy among consumers is vital. Education on digital financial services and best practices for cybersecurity can empower individuals to navigate the digital financial landscape safely. By understanding the risks and implementing preventive measures, consumers can better manage their finances and protect their personal information.

International Collaboration and Future Outlook

The RBI report also touches on the internationalization of the rupee and its role in the evolving digital financial landscape. Through Project Nexus, India is collaborating with countries like Malaysia, the Philippines, Singapore, and Thailand to facilitate instant cross-border payments. This initiative aims to enhance the efficiency of international transactions and promote the use of the rupee globally.

As the financial sector continues to embrace digitalization, balancing the benefits with the associated risks is crucial. While digital advancements offer numerous advantages, acknowledging and addressing the dark side of digitalization is essential for maintaining a secure and stable financial system.

Conclusion

In conclusion, the dark side of digitalization presents significant challenges, including impulsive expenditure and the threat of data breaches. The RBI’s Currency and Finance report for 2023-24 highlights these concerns, emphasizing the need for regulatory measures and enhanced cybersecurity. By addressing these issues and promoting financial literacy, we can mitigate the risks and ensure a more secure and stable digital financial environment. The future of finance is digital, and it is our collective responsibility to navigate it with caution and awareness.